Understanding the process!

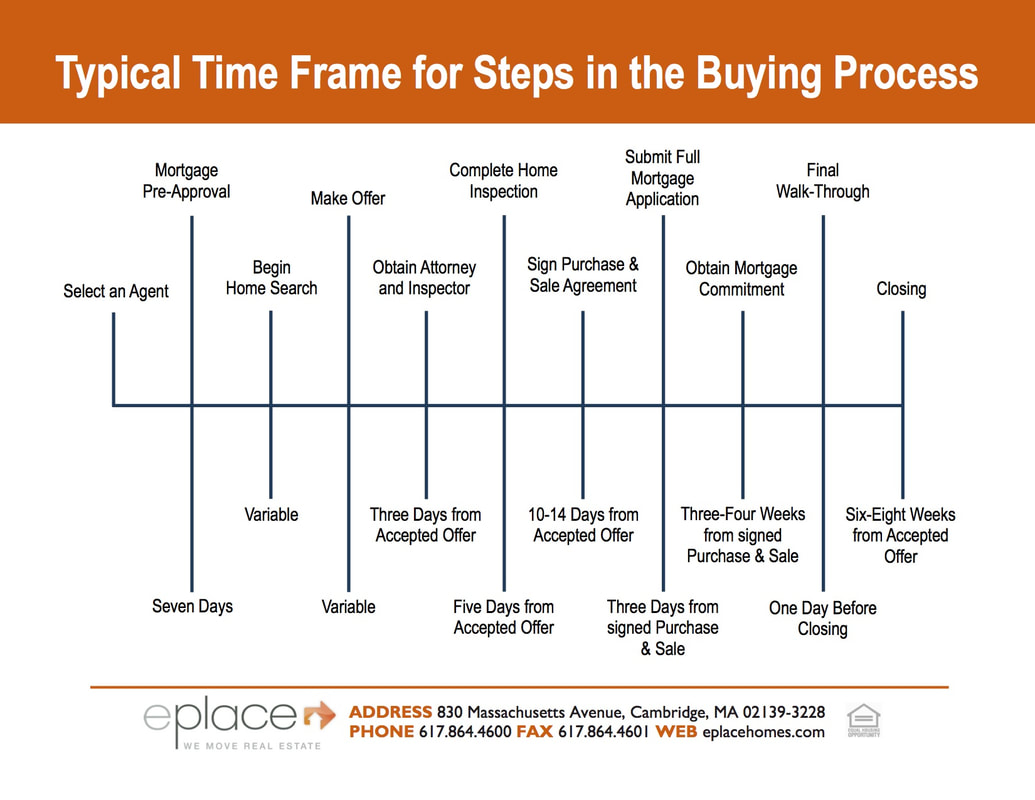

The first step in buying your home is selecting an agent you can trust. Having the right agent, is like having the right quarterback. They will be the one to help assemble your winning team, educate you on the buying process, negotiate the best available deal on your behalf, and hopefully get you and awesome closing gift!

Once you have found the right agent, they will recommend their trusted lenders to help you get a pre approval letter from a lender. This is a crucial step that should not be delayed. This will tell you what your maximum budget is, and help you when it comes time to make an offer.

Now that you have your pre-approval letter, lets start your search. As your agent, this is when we sit down and discuss exactly what kind of home you are looking for. I will set you up in MLS (multiple listing service) and you will receive emails every time a home that matches your search criteria hits the market. To join my MLS now, please Click Here. Timing is everything, and being aware of a new property the day it comes on the market, sometimes even before, can make all the difference. It is important that you see as many homes as possible. This way when “the one” shows up, you will know it! I always try and give my buyers a small folder to take with them, equipped with some background information on the property, a pros and cons sheet, and a stack of business cards to sign into open houses with.

HERE IS THE DIFFERENCE! Once you find the home you want to make an offer on, you MUST obtain a CMA (comparative market analysis) from your agent. A CMA is a report that will help you determine the market value of that particular home, and help determine what a good offer price should be. I cannot express this enough, without a proper CMA you may submit offer after offer with the same results, or over pay for the property. For a sample of my CMAs feel free to email me. When you submit the offer it is accompanied by a $1,000 deposit check as well as a copy of your pre approval letter from your lender. This $1,000 is credited toward your down payment.

Congratulations, thanks to your agents amazing negotiations and winning strategies, your offer has been accepted! Now it is time to meet your agents trusted real estate attorney and home inspector. One piece of advice here, make sure that your attorney is a REAL ESTATE attorney. Though most transactions are fairly straight forward, real estate can be complex at times, and it is critical that you have an expert in your corner, should anything unordinary take place.

Once you have completed the home inspection and finalized the agreement, its time to sign the Purchase and Sale agreement. Your attorney will have reviewed and discussed all the fine details of this agreement with you prior to you signing the P&S. It is typical that you will put down 5% of the purchase price (minus the $1,000 you paid with the offer) at the time of signing. This figure can vary depending on your loan and your negotiation strategy.

Once you have a fully executed purchase and sale agreement you can complete your mortgage application. At this time the bank will order and appraisal of the property and make sure they have all your documents to start underwriting the loan. I recommend having everything ready for the bank as soon as possible. You will need to provide the bank with items such as; last two years tax returns, w-2s/ 1099s, bank statements, retirement account statements, etc.

After the lender has reviewed all of your information and sent the loan to underwriting, we can expect to receive a mortgage commitment from the lender. At this point we will schedule the final walk through and then get the keys to your new home at the closing! You did it, you are now a proud home owner!!